Seminar : “Perkembangan Industri Retail di Bandung & Jawa Barat “

Seminar : “Perkembangan Industri Retail di Bandung & Jawa Barat “Tempat : Hotel Preanger Bandung, 25 Agustus 2008

Peserta : Peritel, Supplier, Dewan Pemerintahan kota Jawa Barat

Pembicara : Yongky S. Susilo, Retailer Service Director Nielsen Indonesia

Belum lama ini saya menghadiri seminar yang diadakan oleh APRINDO – Dewan pengurus Daerah Jawa Barat. Mari kita lihat bersama apa saja yang diulas dalam seminar tersebut.

Belum lama ini saya menghadiri seminar yang diadakan oleh APRINDO – Dewan pengurus Daerah Jawa Barat. Mari kita lihat bersama apa saja yang diulas dalam seminar tersebut. Seminar tersebut dibuka oleh beberapa kata sambutan terutama dari ketua APRINDO Jabar, Bp. Budi Siswanto Basuki yg juga presdir dari Ritel Yogya & Yomart, dan dari Kepala Dinas Perindustrian & Perdagangan Jabar, Drs. H. Agus Gustiar, M.Si.

Seminar tersebut dibuka oleh beberapa kata sambutan terutama dari ketua APRINDO Jabar, Bp. Budi Siswanto Basuki yg juga presdir dari Ritel Yogya & Yomart, dan dari Kepala Dinas Perindustrian & Perdagangan Jabar, Drs. H. Agus Gustiar, M.Si.Beberapa hal yg harus digarisbawahi adalah bahwa akan dibentuk undang-undang untuk mengatur mengenai perijinan pendirian ritel modern di suatu wilayah, misalnya dari segi tata ruang, zonasi. Selain itu pesan dari Bapak Agus agar persaiangan antara pasar modern dan pasar traditional tetap terbina :

- Peritel Modern sebaiknya tidak merusak pasaran produk terutama produk komoditi dengan menjual nya sangat murah.

- Peritel modern harus mengikuti segala jenis peraturan yang berlaku seperti SNI, perijinan dll.

- Peritel modern hendaknya peduli lingkungan, misalnya dengan menjual harga khusus produk tertentu kepada masyarakat ekonomi ke bawah.

Executive Insights :

- Traditional trade still dominates the Asia grocery outlets

- The More Develop, the country will have bigger population per store (less store number) due to efficiency in trade structure; however countries with large rural area are in show pace.

- Modern trade is gaining importance in Asia due to supply (local and foreign expansion) and demand (urban consumers behavior changes and manufactures distribution effectiveness); large format and convenience stores are most growing formats.

- Supermarket format are loosing relevance to the consumers in many markets due to hypermarket and convenience store acceptance.

- Indonesia, India, Sri Lanka, Philippines, Vietnam are in the group of countries where traditional shopping as main store; Main reasons are convenient / within walking distance

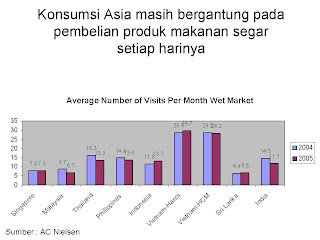

- Fresh produce is still purchased on daily basis in Asia, takes 50% of shoppers budget, and done in wet market; therefore fresh category is key driver for building grocery business.

Memang saat ini sangat dirasakan bahwa pasar modern perlahan mulai mengambil share dari pasar traditional, hal ini sebenarnya sudah menjadi rahasia umum, jelas saja begitu secara nyata kita bisa liat bahwa semua nya lebih baik di pasar moder daripada di pasar traditional :

- Infrastruktur

- Management

- Koordinasi kerja

- Distribusi barang

- Sistem Waralaba / frenchise yang memungkinkan meluasnya brand image ritel lbh luas.

- Suasana belanja yg menarik, fun dan full entertainment.

Trend ke depan untuk outlet memang cepat atau lambat akan menjadi modern ritel yaitu dengan konsep self service, bukan hanya mempercantik outlet saja, karena itulah ”jantung” nya ritel modern IMPLUSE BUYING.

Pasar Traditional

Bagaimana dengan peluang pasar traditional sendiri, jika kita sempitkan pasar traditional yaitu pasar basah (wet market) maka peluang nya adalah masih sangat besar. Karena di Indonesia sendiri, populasi rural masih 60% dibandingkan populasi urban.

Survey shoppers behavior menunjukkan bahwa konsumsi untuk product fresh 50% dari total spend money masyarakat Asia.

Maka peluang perkembangan pasar masih cukup besar,

Mengapa?? Karena seperti hal nya di negara Asia lainnya, penduduk di Asia masih terimage “beli makanan fresh ya di pasar”. Hal ini lah yang membuat ritel international seperti Tesco, Carrefour, Wal*mart sedikit kesulitan menembus negara-negara di Asia. Ambil contoh, Masyarakat di China suka sekali makanan fresh, seperti ikan, ayam yang dipotong dalam keadaan hidup-hidup. Jika di pasar traditional dapat menyediakan hal ini dengan adanya kolam besar, kandang ayam.. apakah di pasar modern bisa??

Selain itu image murah memang masih sangat melekat di pasar, apalagi ditambah dengan sistem tawar menawar yang merupakan ciri khas dari pasar basah & excitement yg tidak bisa diganggu. (Bagi ibu-ibu nawar IDR 50 perak saja sudah bisa bikin puas)

Dari grafik ini dapat dilihat bahwa memang frekuensi pergi ke pasar basah masih sangat tinggi, selain karena kesukaan mereka akan produk fresh, ternyata juga dipengaruhi dari tingkat perekonomian. Bahkan untuk masyarakat vietnam hampir setiap hari pergi ke pasar. Apakah ini karena mereka ga bisa beli kulkas??? (kemungkinan besar)

Dari grafik ini dapat dilihat bahwa memang frekuensi pergi ke pasar basah masih sangat tinggi, selain karena kesukaan mereka akan produk fresh, ternyata juga dipengaruhi dari tingkat perekonomian. Bahkan untuk masyarakat vietnam hampir setiap hari pergi ke pasar. Apakah ini karena mereka ga bisa beli kulkas??? (kemungkinan besar)So, sebetulnya jika mau disimpulkan untuk traditional store :

- Opportunity : massive presence and highest visits

- Challenge : Difficult to distribute and lesser basket size

- Consumer centric : No experiential shopping.

Executive Insight

- Traditional stores getting small basket

- Modern gaining big basket (bulk and impulse purchase)

- key to improve and grow is; distribution and buying power group

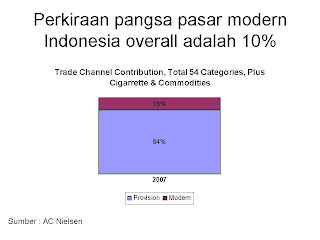

Memang sih belakangan ini ribut-ribut soal pertumbuhan modern market yang benar-benar pesat. Apakah benar ? coba kita lihat grafik di bawah :

Jika komoditi rokok dan sembako dimasukkan maka langsung keadaan berbalik, bahwa pasar traditional masih memegang kendali yang cukup kuat. Walopun jika rokok dikeluarkan terkesan modern trade mulai naik.

Jika komoditi rokok dan sembako dimasukkan maka langsung keadaan berbalik, bahwa pasar traditional masih memegang kendali yang cukup kuat. Walopun jika rokok dikeluarkan terkesan modern trade mulai naik.WET Market SWOT

- opportunity : Cheap, Fresh, Location, top experiential

- Challenge : Urban society changes, city development, Pasar facilities, Food safety.

- Consumer centric : growing demands of younger consumer

Executive Insight

Just after they got married, wet market is in their shop repertoire as they seek for healthy fresh products for the family.

- The market place have been running down and deter young and affluent consumer and its family members to visit and shop.

- Physical access to wet market have been distorted by lack of security and PKL (Pedagang Kaki Lima)

- Consumer is increasingly demanding and less loyal.

- Their mid low customers may have moved residence due to inner city development.

- Dry grocery is purchased in monthly manner in modern market, that leave weekly and daily topping up purchased only (small basket)

- New stores (both traditional and modern) open up closer to consumers residence.

- Home delivery dry grocery product by carts / mobile (by cellphone)

- Wholesaler (grosir or agen) now do retailing to end user also (to maintain business)

- Wet market is the least option for family shopping destination, while they tend to spend quality time together in leisure time.

- Men are also getting active in shopping and wet market is definitely not in the aspiration list.

- Easily turn into cash flow problem, less revenue and increasing coast

- No capital loan to extend business

- No buying power against bigger player.

- Food sellers buys in bulk from the traditional retailers

- They are more loyal; each has its own customers; have developed reward system

- They tend not to go to modern market as they need bulk materials, non branded ‘curah’and may be traditional items (bumbu)

- Modern market is irrelevant to their business (so modern market location is irrelevant too)

- fresh is dominantly still bought in wet market

- they provide good variety of products and consistent sources

- Supper and Hypermarkets is irrelevant since consumers seek for top health choice

- Fresh at modern retail is perceived as frozen and day old; since they do not have good turn over, their variety is not as big as wet market.

Take outs : The retail Business

- Consumer is at the center of business

- It is the battle for consumer’s

- share of wallet

- share of mind

- share of heart

- share of mouth - consumer decide who win, survive or die

- Make your self always relevant to consumer

Source : Florenz's speech & AC Nielsen Presentation

-FlorenZ-

Tidak ada komentar:

Posting Komentar